When it comes to higher education, the conversation surrounding tuition costs and student debt is ever-present. And with good reason – according to The Institute for College Access & Success, the average American student graduating from college in 2018 had $29,200 in student loan debt. For students attending public colleges and universities in New York State, Myualbany.edu reports that the average amount of debt per borrower was even higher at $31,183. With numbers like these, it’s no wonder that students and their families are struggling to make ends meet.

It’s no secret that college tuition costs have been rising steadily for years. And as tuition costs continue to climb, so does the amount of student debt. In fact, according to the latest data from the Institute for College Access & Success, the average student debt load for the class of 2017 was $28,650. For many students and their families, college is becoming increasingly unaffordable. In this blog post, we’ll take a closer look at tuition costs and student debt at myualbany and explore some possible solutions to this growing problem.

The Cost of Myualbany

The cost of Myualbany varies depending on a student’s major, whether or not they live on campus, and other factors. For example, the average cost of tuition and fees for an in-state student pursuing a bachelor’s degree is $9,139 per year. Out-of-state students can expect to pay significantly more, with an average annual cost of $27,351.

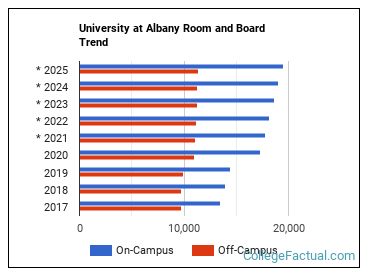

Room and board costs also vary depending on a student’s situation. Those who live on campus can expect to pay an average of $11,857 per year for room and board, while those who live off campus will need to budget for additional expenses like rent, utilities, and groceries.

Myualbany offers a variety of financial aid options to help students cover the cost of their education. Scholarships and grants are available for those who qualify, and student loans can be used to supplement other forms of financial aid. Students are encouraged to speak with a financial aid advisor to discuss all of their options.

Student Loans and Debt

The average college graduate in the United States has over $37,000 in student loan debt. This can be a huge burden for young adults who are just starting out in their careers. If you’re considering taking out loans to help pay for college, it’s important to understand the different types of loans available and how they can impact your future finances.

There are two main types of student loans: federal loans and private loans. Federal loans are issued by the government and usually have lower interest rates than private loans. Private loans are offered by banks and other financial institutions, and they typically have higher interest rates than federal loans.

The first step in deciding which type of loan is right for you is to fill out the Free Application for Federal Student Aid (FAFSA). This form will help you determine your eligibility for federal aid. If you’re not eligible for federal aid, or if you need additional funding beyond what federal aid can provide, you may want to consider taking out a private loan.

When taking out a loan, it’s important to understand the terms and conditions of the loan agreement. Be sure to read the fine print carefully before signing anything. Make sure you know how much money you’ll need to repay each month and when the repayment period begins. It’s also important to understand any fees or penalties associated with late or missed payments.

If you’re struggling to repay your student loans, there are options available to help ease the burden. You can apply

How to Pay for Myualbany

Assuming that the reader is a student at Myualbany, there are a few different ways to pay for tuition. The first way is to use financial aid. To do this, the student would fill out the FAFSA form and hope to receive grants, scholarships, or loans. Another way to pay for Myualbany is to use savings, such as money from a part-time job or help from family members. Finally, some students may take out private loans.

Next, the student should research scholarships specifically offered by Myualbany. There are many different types of scholarships available, so it is important to look into all of the options and see if any fit the student’s individual circumstances.

If neither federal financial aid nor scholarships are enough to cover the cost of tuition, the student may have to take out a private loan. It is important to shop around for the best interest rates and repayment terms before signing any loan documents.

Finally, some students may decide to pay for their tuition using money from a 529 Plan or other investment account.

Scholarships and Grants

Grants are also available from federal and state governments, as well as private organizations. Students should research all of their options to ensure they are taking advantage of every opportunity to reduce their tuition costs.

Solved a nment-Responses/last?dep= MyUAlbany UA Mail

As a student, one of the most important things you can do is to stay on top of your assignments. This means not only completing them on time, but also ensuring that your responses are accurate and well-thought-out.

Fortunately, MyUAlbany makes it easy to stay on top of your assignments. With the UA Mail feature, you can easily see when new assignments have been posted and quickly respond to them.

This is a great way to keep on top of your studies and avoid falling behind.

There are a number of scholarships and grants available to help students offset the cost of tuition. The State University of New York (SUNY) offers a variety of merit-based and need-based scholarships, as well as a number of grants for eligible students. In addition, there are a number of private scholarships available from various organizations and foundations.

Once the FAFSA is complete, students will be able to see what types of aid they qualify for. For more information on scholarships and grants, please visit the MyUAlbany Financial Aid Office website.

Conclusion

The rising cost of tuition and student debt is a major concern for many college students and their families. At Myualbany, we understand the financial challenges faced by our students and we are committed to helping them succeed. We offer a variety of financial aid options, including scholarships, grants, loans, and work-study programs, to help make college affordable. We also offer numerous resources to help students manage their finances and repay their loans. If you are concerned about paying for college, we encourage you to reach out to our financial aid office to learn more about your options.